Probate is supposed to honor a loved one’s last wishes, but for many heirs it feels more like an emotional roller-coaster strapped to a ticking financial clock. Funeral costs, mortgage payments, medical bills, and daily living expenses rarely wait the 9–18 months it can take an estate to wind through court. As tension mounts, heirs often make hurried choices—selling family property at a discount or accepting low offers from impatient buyers—simply to keep the lights on. Probate funding offers an alternative: immediate liquidity that gives families the time and mental space to plan instead of react.

The Emotional Overload

Grief clouds judgment. Psychologists call it “cognitive load,” and during probate that load skyrockets. Executors juggle legal paperwork while siblings debate sentimental versus market value for heirlooms. A modest infusion of funds can lower the temperature, allowing families to resolve conflicts with clarity and respect rather than panic and resentment.

The Hidden Financial Timelines

Court calendars and creditor notices introduce rigid deadlines that clash with real-life cash flow. Property taxes come due twice a year; car notes and student loans arrive monthly. When estate accounts are frozen, personal savings disappear fast. A probate advance converts a portion of the expected inheritance into cash now, with repayment coming from the estate later—no monthly interest, no personal liability. That structure empowers heirs to meet short-term obligations without sacrificing long-term value.

How Funding Creates Breathing Room

Because probate advances are tied solely to the estate, they do not appear on credit reports or affect debt-to-income ratios. Heirs can therefore keep existing lines of credit intact and avoid high-interest borrowing. More importantly, immediate funds buy time—time to get multiple appraisals, consult tax professionals, and negotiate from a position of strength rather than desperation.

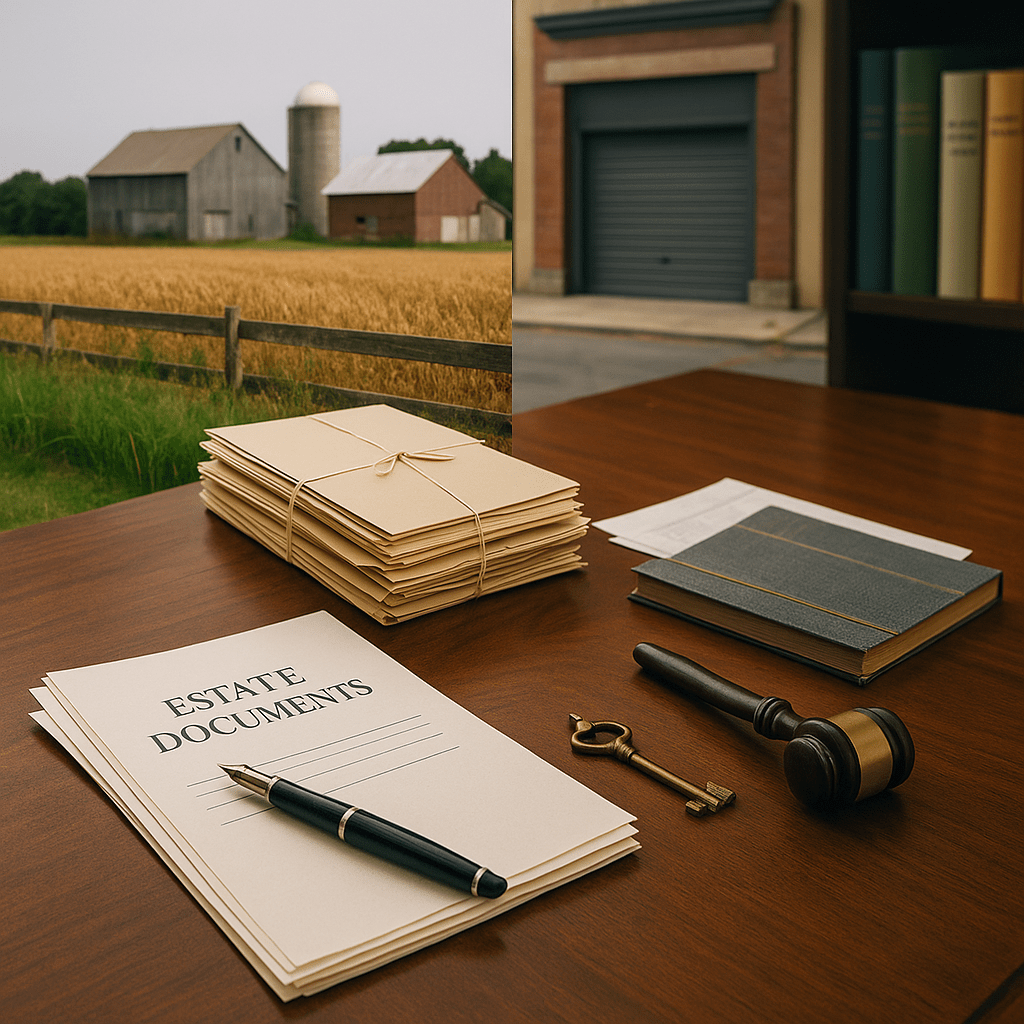

Scenarios Where Liquidity Changes Everything

Global Families

Consider heirs residing overseas who must coordinate attorney signatures, currency conversions, and international travel. For heirs residing overseas, advance funding can underwrite airfare for essential court appearances or simply offset the costs of maintaining two households while probate drags on.

Public-Benefit Recipients

Cash-strapped beneficiaries sometimes worry that a sudden windfall will jeopardize critical aid. Fortunately, properly structured advances can be designed so that those receiving Medicaid benefits remain within eligibility thresholds, preventing a lapse in coverage while still easing financial pressure.

Opportunity-Focused Heirs

Not every heir is in crisis. Some see inheritance as seed capital. For investment-minded heirs, accessing funds sooner lets them lock in attractive market entries—whether that means purchasing a rental property before rates rise or diversifying a portfolio without waiting a year for probate to close.

Debt-Burdened Millennials

Student loans and high housing costs leave younger beneficiaries little margin for surprise expenses. Advance funding can help millennials balancing debts and inheritances pay down high-interest balances immediately, potentially improving credit scores long before the estate is distributed.

Freelancers and Gig Workers

Variable income makes a prolonged probate delay especially risky for self-employed individuals. Access to cash now helps freelancers facing income gaps during probate cover quarterly taxes, equipment upgrades, or simply the rent between gigs, safeguarding both livelihood and legacy.

Emotional Space Leads to Better Decisions

Liquidity alone doesn’t resolve every conflict, but it transforms the conversation. When heirs know the mortgage is paid through next spring, they can step back and weigh whether selling Grandma’s house truly aligns with her wishes—or whether renting it for a year might yield better returns. That pause fosters collaborative decision-making and often preserves family relationships long after probate ends.

Choosing a Funding Partner

Not all providers are created equal. Look for transparent fee structures, a clear timeline for disbursement, and the ability to tailor advances to individual needs—whether that means a lump-sum payment, staged draws, or specialized guidance for an inheritance advance larger than immediate obligations require. Reputable companies will coordinate directly with the estate attorney, protecting heirs from administrative headaches.

Final Thoughts

Probate sits at the crossroads of sorrow and strategy. While no amount of money can erase the emotions of loss, timely funding can prevent those emotions from steering families toward hasty, expensive choices. By exchanging a small slice of future proceeds for present flexibility, heirs gain the luxury of perspective—time to honor memories, consult experts, and craft a financial plan that respects both the deceased’s intentions and the living heirs’ futures.